Bear Flag

In technical analysis, chart patterns help traders recognize high-probability setups in the market. One of the most reliable continuation patterns during a downtrend is the Bear Flag. Recognizing this pattern early can help traders position themselves before the next move unfolds.

- What Is a Bear Flag Pattern?

- What Does It Mean?

- Key Characteristics of a Bear Flag

- How to Trade the Bear Flag

- Example in Action

- Final Thoughts

What Is a Bear Flag Pattern?

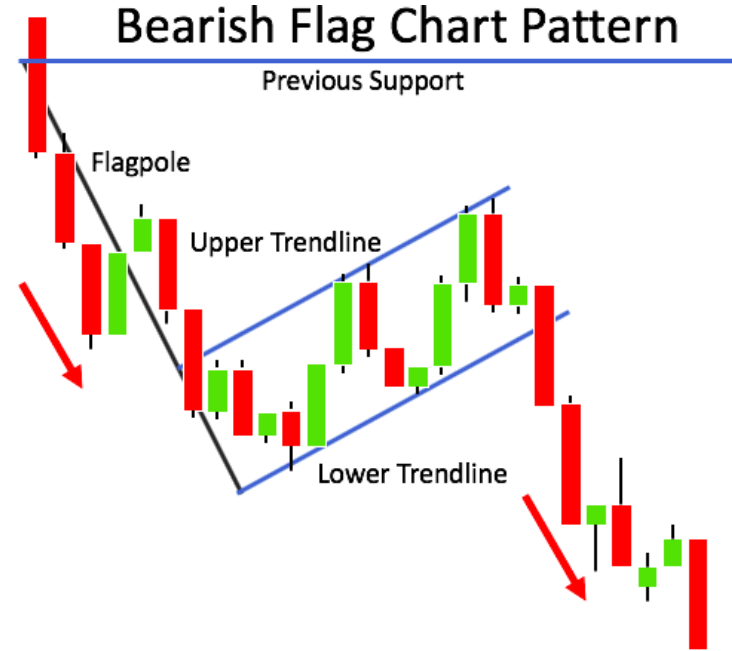

A Bear Flag is a continuation pattern that appears during a downtrend. It reflects a temporary pause or consolidation before the price continues to move lower.

The pattern consists of two parts:

- The Flagpole: A sharp and strong downward move, showing heavy selling pressure.

- The Flag: A short period of consolidation where the price moves slightly upward or sideways in a small channel — often resembling a rising flag.

Visually, it looks like a flag flying on a pole — but pointing upward during a downtrend.

Bear Flag are used by the WiXy AI algorithm. It is one of the indicators used to determine if WiXy.ai should look for a Bearish signal.

What Does It Mean?

The Bear Flag tells us that sellers are in control, but after a big drop, the market takes a short “breather.” During this pause, some traders may take profits, and others might enter late long positions, causing a slight upward pullback.

However, this rally is usually weak and short-lived. Once the pattern is complete, sellers return and push the price even lower, continuing the downtrend.

Key Characteristics of a Bear Flag

To confirm a Bear Flag, look for:

- A steep drop in price (the flagpole).

- A tight, upward-sloping channel (the flag).

- Declining volume during the flag formation.

- A breakdown below the lower boundary of the flag, often accompanied by rising volume.

This breakdown signals a possible entry for a short trade.

How to Trade the Bear Flag

Here’s a basic strategy for trading this pattern:

- Identify the flagpole: Look for a strong downward move.

- Wait for the flag to form: A brief upward or sideways consolidation.

- Set your entry: Consider entering short when the price breaks below the lower trendline of the flag.

- Manage risk: Place a stop-loss above the upper trendline of the flag.

- Set a target: A common method is to project the length of the flagpole downward from the breakout point.

Example in Action

Imagine a stock falls sharply from $50 to $40 — this is your flagpole. Then it bounces back up to $43 in a tight channel. If it breaks down below $42 with strong volume, the next move could take it to around $33, based on the flagpole height.

Final Thoughts

The Bear Flag pattern is a powerful tool for traders who want to ride the trend instead of fighting it. It’s not about predicting the market — it's about reading its signals and reacting with discipline. When used alongside volume, support/resistance levels, and proper risk management, the Bear Flag can become a valuable weapon in your trading strategy.

Keep learning, keep practicing — and soon, spotting patterns like these will feel second nature.

Create a Free Account at WiXy.ai and begin your adventure in the Crypto Space.

Learn more from these articles

A Track Record of Winning.

WiXy.ai delivers. Built on data.

Proven by results. Backtested, battle tested and ready for you.