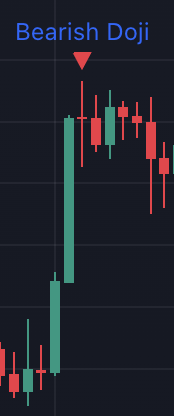

Bearish Doji

A Bearish Doji appears when a candle has a small or non-existent body, with shadows on both sides, and forms near a resistance zone or after a rally. It reflects market indecision and often signals weakening bullish momentum.

- What is a Bearish Doji

- Why is it Bearish

- How to recognize it

- How to use it in trading

- Final thoughts

What is a Bearish Doji

A Doji is a candlestick where the opening and closing prices are almost equal, resulting in a very small or nonexistent body. A Bearish Doji forms when this neutral candle appears after a bullish trend or strong upward move.

It represents a moment of indecision: buyers push the price up during the session, but sellers pull it back down before the close — or vice versa — leading to a stalemate. This balance often marks a loss of bullish momentum.

Why is it Bearish

On its own, a Doji is neutral. But when it shows up after a strong rally, it signals that buying pressure may be fading. It’s a red flag that the bulls are losing steam and that the bears might be preparing to take over.

What transforms a regular Doji into a Bearish Doji is:

- Its position at the top of an uptrend

- Confirmation by a bearish candle in the next session (such as a strong red candle)

- Occurrence near a resistance level

Bearish Doji's are used by the WiXy AI algorithm. It is one of the indicators used to determine if WiXy.ai should look for a Bearish signal.

How to Recognize It

Look for:

- A tiny body centered between a shadow above and below (or sometimes with one shadow longer)

- Appearing after multiple green candles

- Accompanied by lower volume or sudden spike in volume showing distribution

It’s especially effective when combined with other bearish signals like:

- Overbought indicators (e.g. RSI)

- Divergence in momentum

- Bearish reversal patterns

How to Use It in Trading

A Bearish Doji is not a standalone signal — it's a warning, not a trigger. Wait for confirmation (usually a red candle with a lower close) before taking action.

Once confirmed, traders might:

- Close or reduce long positions

- Enter short trades with tight risk management

- Watch for further bearish patterns to build conviction

Final Thoughts

The Bearish Doji may be a small candle, but its message can be loud and clear: the uptrend may be over. By paying attention to where and when it forms, traders can anticipate market shifts early — turning hesitation into opportunity.

Stay alert, stay disciplined, and let the candlesticks guide your next move.

Create a Free Account at WiXy.ai and begin your adventure in the Crypto Space.

Learn more from these articles

A Track Record of Winning.

WiXy.ai delivers. Built on data.

Proven by results. Backtested, battle tested and ready for you.