Falling Wedge

In the world of trading, recognizing patterns can give you a powerful edge. One such pattern that often signals a shift in momentum is the Falling Wedge. While it may look bearish at first glance, this pattern often hides a bullish message — a breakout may be just around the corner.

- What Is a Falling Wedge?

- What Does It Tell Us?

- Key Characteristics

- Why It Matters

- Trading the Falling Wedge

- Final Thoughts

What Is a Falling Wedge?

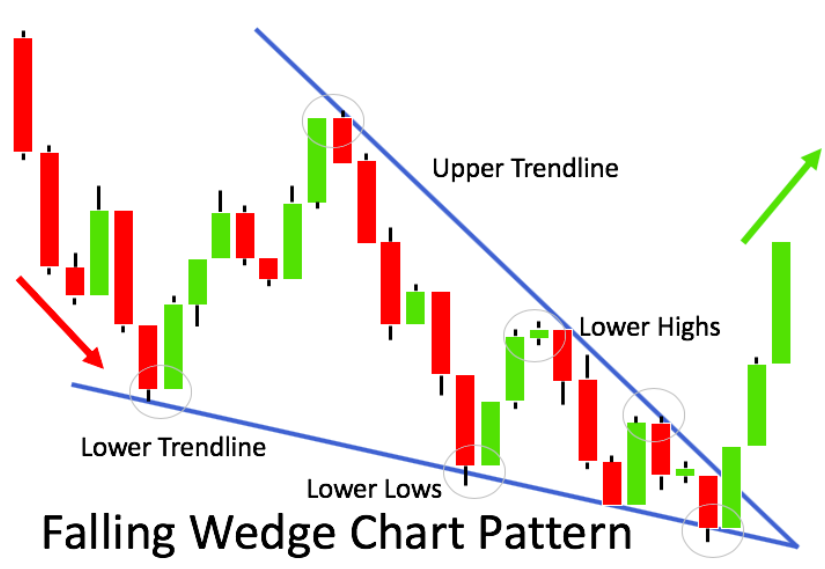

A Falling Wedge is a bullish chart pattern that forms when price action is confined between two downward-sloping, converging trendlines. Both the highs and lows are falling, but the lower highs descend faster than the lower lows. Over time, this creates a narrowing shape that resembles a wedge pointing downward.

This pattern can occur in two main contexts:

- As a continuation pattern during an uptrend.

- As a reversal pattern at the end of a downtrend.

In both cases, the result is often the same: a bullish breakout.

Falling Wedge are used by the WiXy AI algorithm. It is one of the indicators used to determine if WiXy.ai should look for a Bullish signal.

What Does It Tell Us?

The Falling Wedge indicates that while the price is falling, the selling pressure is slowing down. Buyers are gradually stepping in, and the downward momentum is weakening. This tug-of-war creates a buildup of potential energy. Once the resistance of the upper trendline is broken, that energy is released — often triggering a strong upward move.

Key Characteristics

To confidently identify a Falling Wedge, look for these traits:

- Downward-sloping support and resistance lines that converge.

- Volume decreasing as the pattern develops, showing consolidation.

- Breakout above the resistance line, often accompanied by a volume spike.

- Confirmation if the price retests the broken trendline and then continues upward.

Why It Matters

Traders value the Falling Wedge because it:

- Signals the end of selling pressure.

- Offers favorable risk-reward setups.

- Can act as a launchpad for strong bullish momentum.

Especially in volatile markets, spotting a Falling Wedge early can prepare you for a potential breakout and allow you to position accordingly — with clear entry and exit points.

Trading the Falling Wedge

Here’s a basic approach:

- Identify the wedge with converging trendlines on lower highs and lower lows.

- Wait for the breakout, ideally on increased volume.

- Enter the trade on the breakout or on a retest of the broken resistance line.

- Set a stop-loss just below the wedge’s support.

- Target a price move equal to the height of the wedge at its widest point.

Final Thoughts

The Falling Wedge is more than just a pattern — it’s a sign that the bulls are regrouping. Where others might see weakness, the trained eye sees potential. With patience, discipline, and confirmation, this pattern can lead to high-probability trading opportunities.

Keep sharpening your skills, and you'll start spotting Falling Wedges with confidence — often before the crowd catches on.

Create a Free Account at WiXy.ai and begin your adventure in the Crypto Space.

Learn more from these articles

A Track Record of Winning.

WiXy.ai delivers. Built on data.

Proven by results. Backtested, battle tested and ready for you.